For many young people, university life is their first money management experience. Financial education, an important component in one’s education, is the one thing that many of us were inadequately prepared to handle when we enter university.

While you could be forgiven for intending to be nose-deep in books, perhaps it is time to take a minute and plan on how you’ll be managing your money. Do you have a budget? Or are you spending on the go? With basic money management techniques, you can feel confident about your ability to manage your finances. For a start, avoid these common money management mistakes.

Not knowing where your money is going.

Ever wondered where that 50 ringgit you withdrew from your savings account went? You thought you had at least a 20 ringgit note in your wallet, didn’t you? Overspending is a problem everyone faces, especially university students. Many students drain their savings account in the first year of university and then have to work part-time jobs for basic expenses. Want to know a millionaire’s secret? Live within your means*. In student speak, why buy coffee from that twin-tailed green siren F&B outlet when you can brew your very own speciality coffee.

Not having a plan for your money.

Students often have no plan for how to use the money they might have. Want to go on exchange to our Melbourne campus? Put that down as a goal and start putting aside some funds for your daily maintenance while there. Having the funds to spend on social activities makes the exchange experience much more beneficial and memorable. Another purpose of planning might be to have an emergency fund to use for unexpected expenses. Your phone got stolen? The emergency fund is there to get yourself a replacement. Common in financial planning is to reward or pay yourself first. That means putting aside a certain percentage of your allowance for savings. And always remember to include debt repayment – student loans, that ‘education loan’ you took from relatives etc., as part of the spending/saving plans. Another goal every student should have is to graduate with as little debt as possible.

Not determining Wants vs Needs.

Many students fail to recognise that living away from their parents’ home also means having to determine their needs versus their wants, to live comfortably. A simple example? Food is a need. So is clean water and a safe home. The latest iced blended coffee available in the market is a want, something that’s nice to have but you can live without. No doubt on some mornings, an iced latte from you-know-where feels like a need, but there are other inexpensive alternatives. Determining wants versus needs will also help you avoid impulse purchases and overspending.

Not saying ‘no’ to peer pressure.

Peer pressure is a powerful phenomenon on university campuses. In universities, peer pressure can be categorised into two; positive pressure – pressure to do better in academics, or pressure to exercise more, and negative pressure includes being coaxed to smoke, or to go on a trip when your budget doesn’t allow it. So, when it comes to negative pressure, students need to understand that it’s okay to say ‘no’.

Knowing that you do not have enough money in your entertainment budget means you need not give in to peer pressure. It should be up to you to decide whether you will unch at the local kopitiam or at that spicy peri-peri chicken place. This is where financial goals are important. You need the self-discipline to concentrate on what you want out of life so you will not overspend. Who knows. Making good personal financial choices could just help bring your friends to make better financial choices too.

Not to abuse student loans.

Taking a loan for education is a heavy decision to make, be it from a financial establishment or friends and relatives. That is why you must understand that the loan you’re taking should only be enough to pay for necessities. You should strive to graduate with as little debt as possible. Once you’ve graduated, you would want to put your earnings and incomes towards achieving your financial goals such as purchasing a car or a property. You certainly won’t want all your earnings to go towards debt payment.

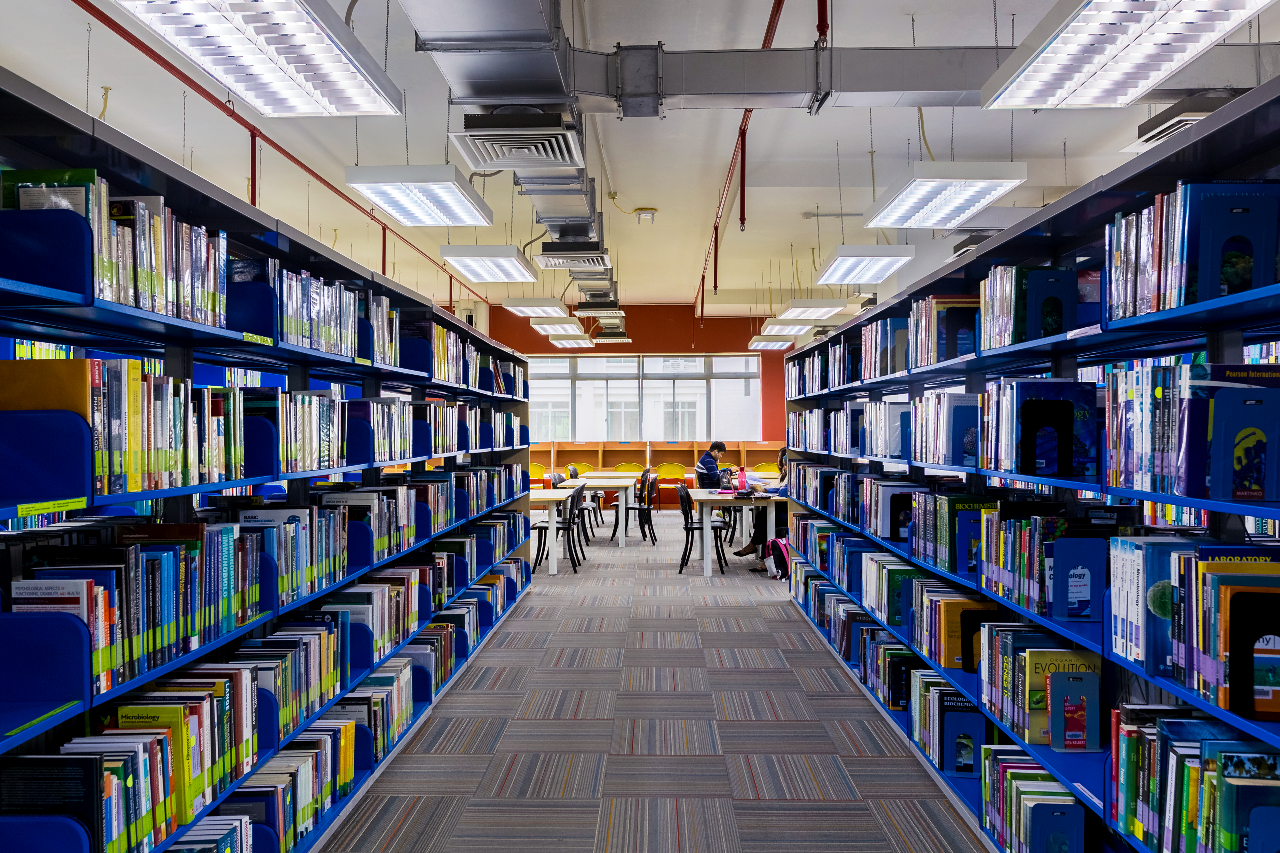

Not utilising what the Library have to offer.

Isn’t it scary how much brand-new textbooks costs nowadays? A brand new edition of some subject textbooks may cost upwards of RM200 each. So, if you must have a textbook, why not get a copy from the library. Our library staff makes every effort to make textbooks more accessible. One way is by putting assigned readings on reserve – a system that allows students access to the book for a few hours at a time. This allows every student to have access to the textbook.

If you can’t find a copy you need, ask the librarians. They might have other resources that you can use. Alternately, why not buy used books from the previous year’s students. It would cost much less. Certain sites online also sell used textbooks for much less. Or a cheaper alternative is buying eBooks. You can save a bundle this way.

Not to be afraid to reach out for help.

Oftentimes students avoid reaching out to others for help until it is too late and they’re already in financial trouble. Avoid doing this. At Swinburne Sarawak, our counsellors are always ready to advise and guide you on what you can do.

No doubt you’ll spend a majority of your time studying for exams, doing coursework, sitting through lectures and participating in projects. University life is so hectic, it would seem such burdensome to plan for the future. But financial planning now is the parachute you need before you jump into the ‘real world’.

One thing many would tell you is that one of life’s greatest satisfaction is having a sense of control over your finances. When it comes to money, as a student you should always strive to remain positive. Good money management habits can be challenging but with a little practice and patience, it is possible. It is an empowering experience and in the long run, it will help you gain confidence in yourself and your ability to be financially successful.

*Elizabeth Gravier; How Millionaires Spend, Save and Invest (2021)